Have you ever wondered why buying electricity for a business feels like stepping back into a 1980s stock exchange floor? While we can send money instantly across the globe or provision cloud servers in seconds, the wholesale energy market is still surprisingly analog, dominated by phone calls, spreadsheets, and middlemen.

Tem, a UK-based startup, is betting $75 million that it can change that dynamic forever.

The company has just announced a significant Series B funding round led by Lightspeed Venture Partners. Their goal? To do for electricity what Stripe did for payments: build a seamless, digital transaction layer that bypasses the clunky intermediaries. By using artificial intelligence to match renewable energy generators directly with corporate buyers, Tem claims it can save businesses massive amounts on their utility bills while ensuring green energy actually gets used efficiently.

How does Tem’s AI transaction engine actually work?

At the heart of Tem’s operation is a proprietary AI transaction engine named Rosso. Think of Rosso as a super-forecaster and a high-speed trader rolled into one.

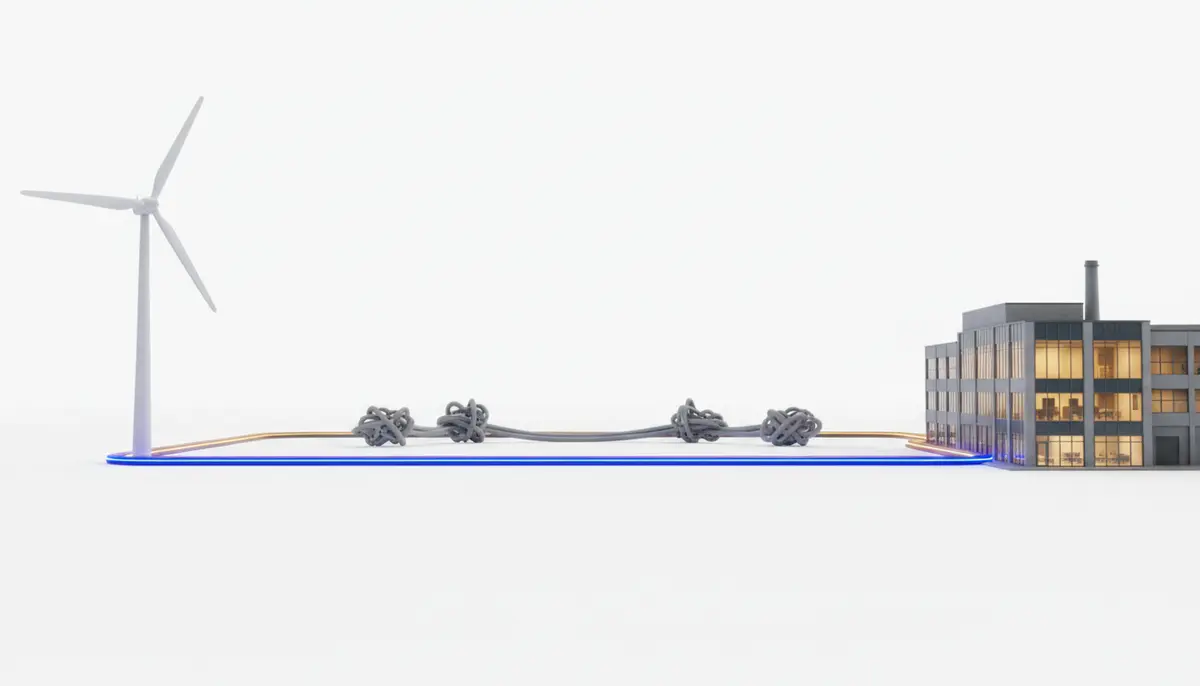

In the traditional model, energy passes through a chain of brokers and utility trading desks before it reaches the end consumer. Each step adds friction, fees, and opacity. Tem’s approach is to cut out the middleman entirely. The Rosso engine analyzes vast amounts of data to forecast energy supply (from wind and solar farms) and demand (from businesses) in real-time.

By predicting these fluctuations accurately, Tem allows companies to buy energy directly from renewable generators. According to the company, this direct-to-consumer model can save businesses up to 30% on their energy bills. It handles the complex risk management and forecasting that large trading desks used to do manually, effectively automating the grid’s financial layer.

Joe McDonald, Tem’s CEO and co-founder, has been vocal about the inefficiencies of the status quo, describing the current energy transaction layer as “fundamentally broken.” The premise is simple: if you remove the brokers and automate the matching process, both the buyer (the business) and the seller (the renewable generator) end up with better margins.

Get our analysis in your inbox

No spam. Unsubscribe anytime.